Practical Solutions for Thriving in the UAE’s Fintech Market

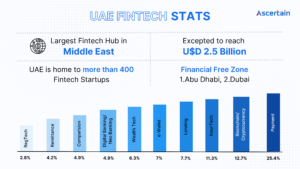

The United Arab Emirates (UAE) is rapidly establishing itself as a global hub for innovation and technological advancement. The UAE’s Fintech market presents a compelling opportunity. With a projected CAGR of 12.56%, the market is expected to grow from $3.16 billion in 2024 to $5.71 billion by 2029.

This growth is fueled by a confluence of factors, including:

- Government Support: The UAE government actively promotes Fintech development through initiatives like the Dubai International Financial Centre (DIFC) Fintech Hive and the Abu Dhabi Global Market (ADGM). These initiatives provide a supportive ecosystem for startups and established players alike.

For Instance, PhonePe users visiting the UAE can now seamlessly pay using UPI at Mashreq Bank’s NEOPAY terminals. This initiative simplifies transactions across stores, restaurants, and tourist attractions. Simply scan the QR code and pay in INR with the current exchange rate reflected.

- High Smartphone Penetration: With a smartphone penetration rate exceeding 90%, the UAE boasts a tech-savvy population primed for adopting digital financial services.

- Large Unbanked Population: A significant portion of the UAE’s population remains unbanked, creating an opportunity for innovative Fintech solutions to provide financial inclusion.

Ascertain: Your Trusted Partner in the UAE’s Fintech Revolution

Ascertain: Your Trusted Partner in the UAE’s Fintech Revolution

The UAE’s Fintech sector is booming, but navigating this dynamic landscape can be challenging. Legacy systems struggle to handle the demands of modern finance, compliance burdens weigh heavy, and keeping pace with innovation feels like a marathon.

Ascertain Technologies is here to be your trusted partner in this exciting journey. We offer a comprehensive suite of cloud-based solutions on AWS that empower banks and businesses of all sizes to overcome these hurdles and thrive in the UAE’s Fintech revolution. Here’s how Ascertain can help you:

Investment Banking:

Investment Banking:

- Pain Point: Siloed data and clunky interfaces make it difficult to offer a seamless online investing experience.

- Ascertain Solution: Build secure and scalable platforms with our Digital Investment & Stock Broking solutions. Foster user engagement with intuitive interfaces and leverage real-time data insights for a competitive edge.

Corporate Banking:

Corporate Banking:

- Pain Point: Manual payment processing is slow, error-prone, and lacks transparency.

- Ascertain Solution: Streamline and automate your payment processes with our Statutory Body Payment Engine. Ensure compliance with regulations and enjoy faster transaction settlements.

Co-operative Banking:

Co-operative Banking:

- Pain Point: Managing lending operations with outdated systems can be cumbersome and inefficient.

- Ascertain Solution: Take control with our robust and user-friendly Lending Management Solutions. Make informed decisions with real-time data and automate loan processing workflows.

Compliance and Governance:

Compliance and Governance:

- Pain Point: The ever-evolving regulatory landscape creates a constant burden on compliance teams.

- Ascertain Solution: Ensure regulatory compliance and mitigate risk with our comprehensive suite of tools like Financial Regulatory Reporting (FRR), Data Quality Management Framework (DQMF), Fraud Monitoring Solution (FMS), and Centralized Compliance Monitoring (CCM). Reduce manual workloads, automate reporting processes, and gain peace of mind with our secure and reliable solutions.

Payment Gateway & Services:

Payment Gateway & Services:

- Pain Point: Accepting online payments can be a complex and fragmented process.

- Ascertain Solution: Accept payments seamlessly and securely with our integrated Payment Gateway & Services. Reduce fraud risks and offer a smooth payment experience for your customers.

Cloud Digital Transformation with Application Re-engineering:

Cloud Digital Transformation with Application Re-engineering:

- Pain Point: Legacy infrastructure and applications hinder innovation and limit scalability.

- Ascertain Solution: Modernize your technology stack with our expertise in cloud migration and application re-engineering. Gain the flexibility and agility needed to stay ahead of the curve in the competitive Fintech space.

Stay Ahead of the Curve with Ascertain

Stay Ahead of the Curve with Ascertain

Ascertain is constantly evolving and adapting to stay at the forefront of technological advancements. We actively participate in industry events, collaborate with leading Fintech players, and invest in research and development to ensure our solutions remain cutting-edge.

By partnering with Ascertain Technologies, you gain a competitive edge, build secure and scalable solutions, and navigate the evolving UAE Fintech landscape with confidence. As the future of Fintech unfolds in the UAE, Ascertain stands ready to be your trusted partner on the path to success.