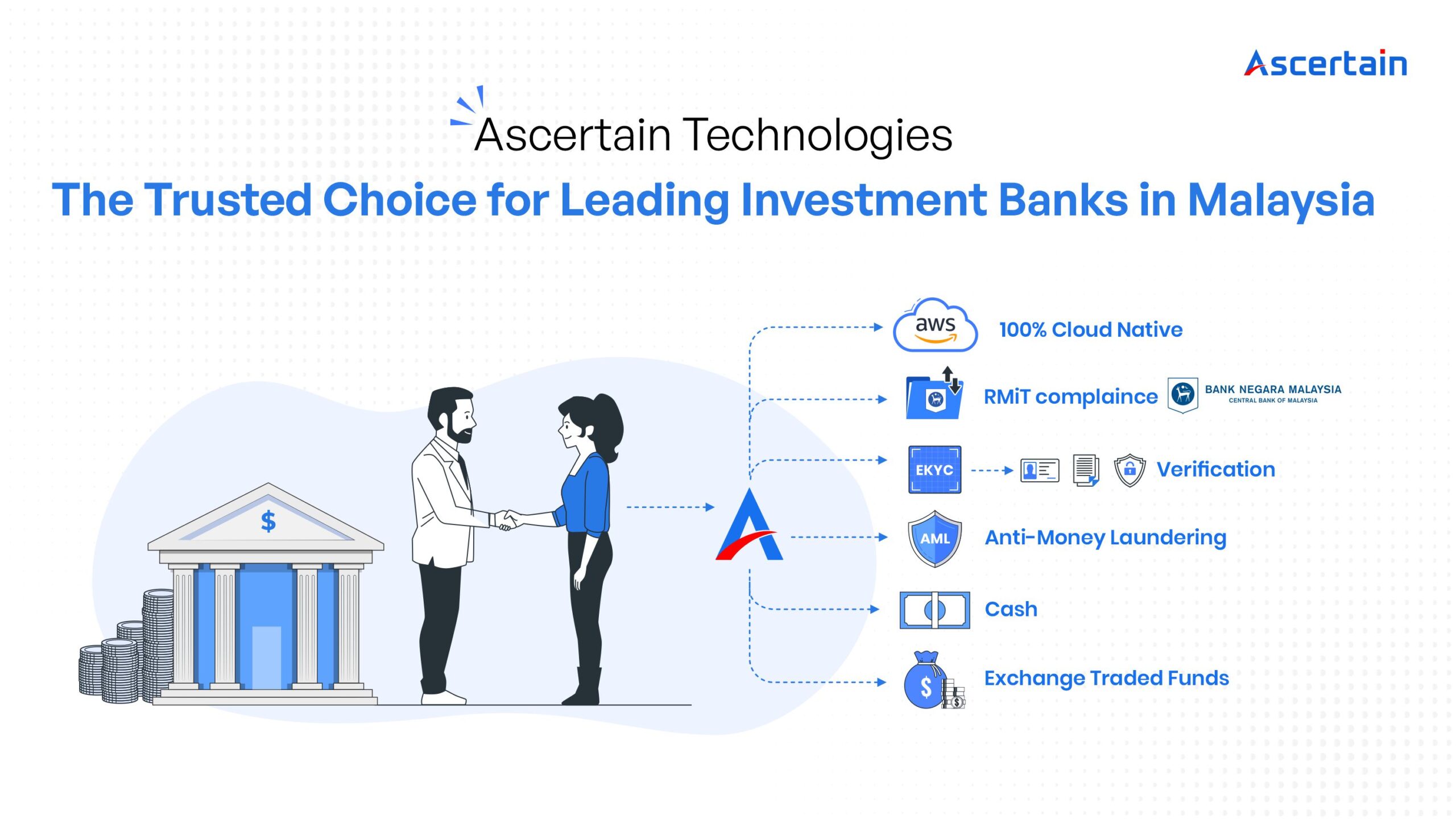

Ascertain: The Trusted Choice for Leading Investment Banks in Malaysia

In the ever-evolving landscape of investment banking, the need for digital solutions has become more pronounced than ever. With rapidly changing market dynamics, investment banks are increasingly looking for ways to streamline their operations, enhance customer experiences, and ensure compliance with stringent regulatory requirements.

According to Statista Market Insights, the global digital investment market is projected to grow by 13.11% (2023-2027) resulting in a market volume of USD 5.27 trillion in 2027

When a renowned investment bank sought a partner to deliver a cutting- edge digital investment platform, they had a choice to make. In the fiercely competitive world of finance, Ascertain Technologies emerged as the clear front-runner. But what were the compelling factors that influenced this prestigious institution to choose us? Let’s delve into the reasons that make Ascertain Technologies the trusted choice for leading investment banks in Malaysia.

Advanced E-KYC, CDD, and AML Processes

Advanced E-KYC, CDD, and AML Processes

In the world of finance, compliance is the bedrock of trust and reliability. Ascertain recognises this fundamental principle and has woven it into the very fabric of our digital investment platform. Our advanced E-KYC (Electronic Know Your Customer), CDD (Customer Due Diligence), and AML (Anti-Money Laundering) processes are second to none. They enable investment banks to verify customer identities, assess risks, and adhere to stringent regulations with unmatched precision. By minimising the compliance burden on customers, we enhance the overall experience, a critical factor that caught the investment bank’s attention.

Diverse Investment Choices: Savings and ETFs

Diverse Investment Choices: Savings and ETFs

Ascertain doesn’t just offer a one-size-fits-all solution. We understand that every investor is unique. That’s why our platform provides two distinct investment choices: ‘Savings’ and ‘ETFs (Exchange-Traded Funds).’ The ‘Savings’ option caters to individuals who prioritise stability and security, while ‘ETFs’ offer a diversified investment approach for those seeking growth and diversification. This adaptability and choice are features that strongly resonated with the investment banking‘s vision.

According to the ETFGI report, the global ETF market is expected to reach $10 trillion by 2024

Meeting Regulatory Requirements with Precision

Meeting Regulatory Requirements with Precision

Compliance is a non-negotiable pillar in the world of finance. Ascertain goes above and beyond to ensure that our digital investment platform adheres rigorously to regulatory requirements in the capital market. We are acutely aware of the regulatory complexities that surround the capital markets. To address this, our platform incorporates several key features to ensure compliance:

- Data Security: Robust data encryption and protection measures safeguard customer data.

- Transaction Monitoring: The platform continuously monitors transactions for any unusual or suspicious activities, ensuring compliance with AML regulations.

- Audit Trails: A comprehensive audit trail feature allows investment banks to maintain a record of all transactions, aiding in regulatory reporting and compliance assessments.

We provide robust measures to safeguard customer data, maintain the integrity of financial transactions, and comply with industry standards. This precision and attention to detail were instrumental in our selection by the investment bank.

Harnessing the Power of AWS Cloud Platform

Harnessing the Power of AWS Cloud Platform

In the digital age, the cloud is the engine of flexibility and scalability. Ascertain proudly boasts its proficiency in utilising the AWS cloud platform. Our solution is 100% implemented in the cloud, offering unmatched scalability, flexibility, and security. It not only ensures data protection but also guarantees business continuity, complying with RMIT (Risk Management in Technology) requirements. This technology-driven approach is aligned with the investment bank’s forward-thinking strategy.

Reliability and Timely Delivery

Reliability and Timely Delivery

A financial institution of high repute demands partners who can consistently deliver with precision and timeliness. We have built a solid track record in meeting these demands, making us the natural choice for the investment bank that values performance and reliability.

Innovation That Speaks for Itself

Innovation That Speaks for Itself

In conclusion, what made leading investment banks choose Ascertain Technologies? It was a combination of our advanced compliance procedures, diverse investment choices, precise regulatory adherence, cloud expertise, and a track record of reliability. We don’t just meet expectations; we exceed them, and that’s why investment banks trust us with their vision for the future.

Are you looking for a right Partner to build your investment banking solutions?

Ascertain Technologies is your partner in unlocking the future of digital investments.