Date

7/November/2023

Share

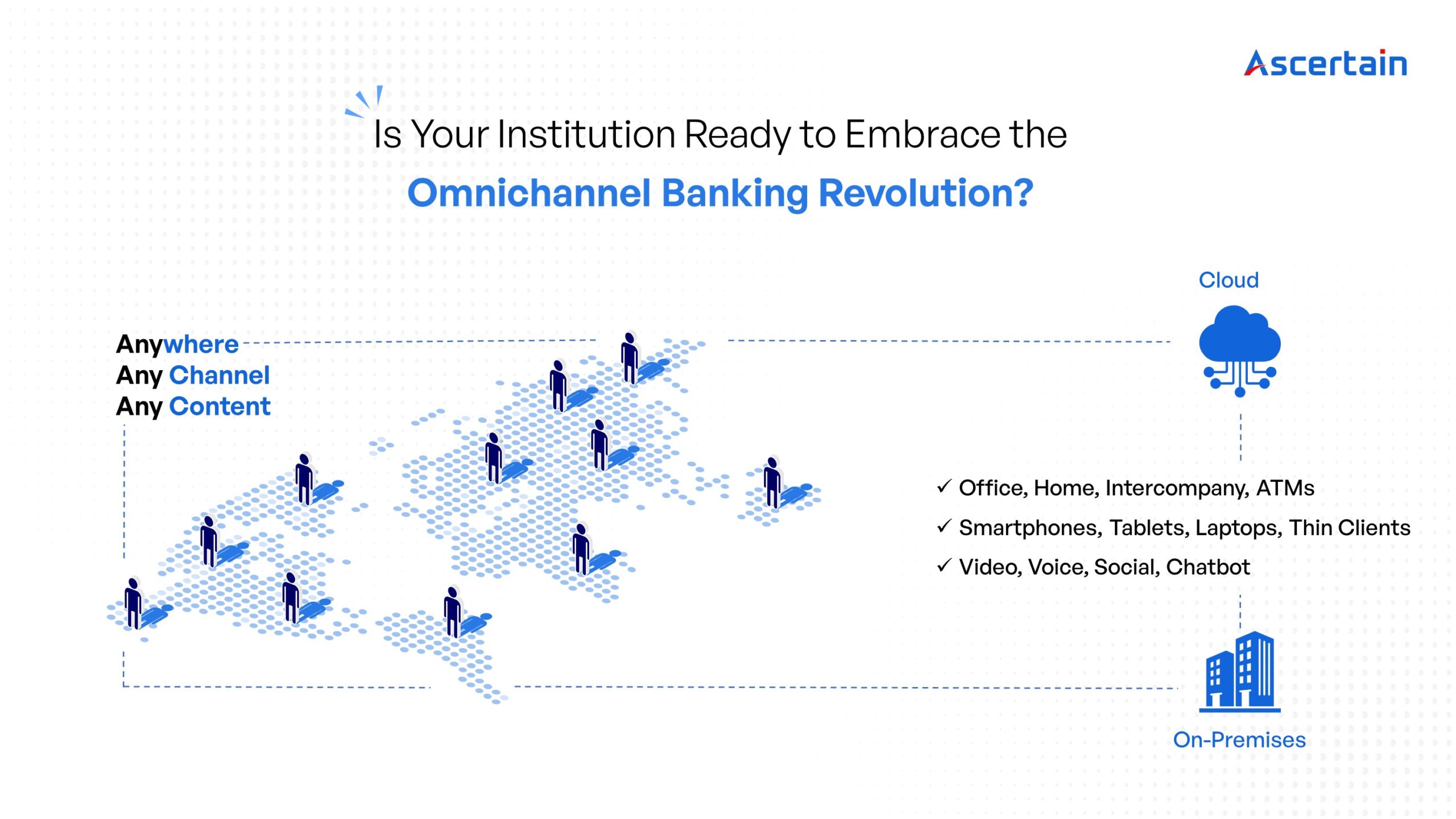

Is Your Institution Ready to Embrace the Omnichannel Banking Revolution?

- Proven Expertise: Ascertain has a track record of delivering cutting-edge fintech solutions and a deep understanding of evolving banking needs.

- Tailored Solutions: We customize omnichannel banking solutions to meet your business’s specific goals and needs.

- Seamless Integration: Our integration minimizes disruptions, ensuring a smooth transition to omnichannel banking.

- Data Security and Compliance: We prioritize data security and regulatory adherence to protect sensitive financial data.

- Personalized Customer Journeys: Empower customer engagement, satisfaction, and loyalty with personalized journeys.

- Support and Assistance: Our 24/7 support ensures you maximize your omnichannel banking system.

- Cost Efficiency: Our solutions reduce operational costs, leading to a more cost-effective and profitable business.

- Competitive Edge: Gain a distinct advantage in a competitive market with omnichannel banking.

- Innovation: Stay ahead of the curve with our latest trends, technologies, and strategies.

- Customer-Centric Focus: Deliver convenience and consistency to meet modern customer expectations.