Unlocking Tomorrow: Top Technology Trends in Banking and Fintech for 2024

In the ever-evolving landscape of banking and fintech, the key to staying ahead is not just adaptation—it’s anticipation. As we stand on the threshold of 2024, a new chapter in the digital era of finance is about to unfold. Join us in Unlocking Tomorrow, where we delve into the top technological trends that will shape the financial industry in the coming year. These aren’t just trends; they are the keys to unlocking unprecedented possibilities, efficiency, and transformative experiences. Get ready to embark on a journey into the future—a future where innovation and finance converge to create a landscape of limitless potential.

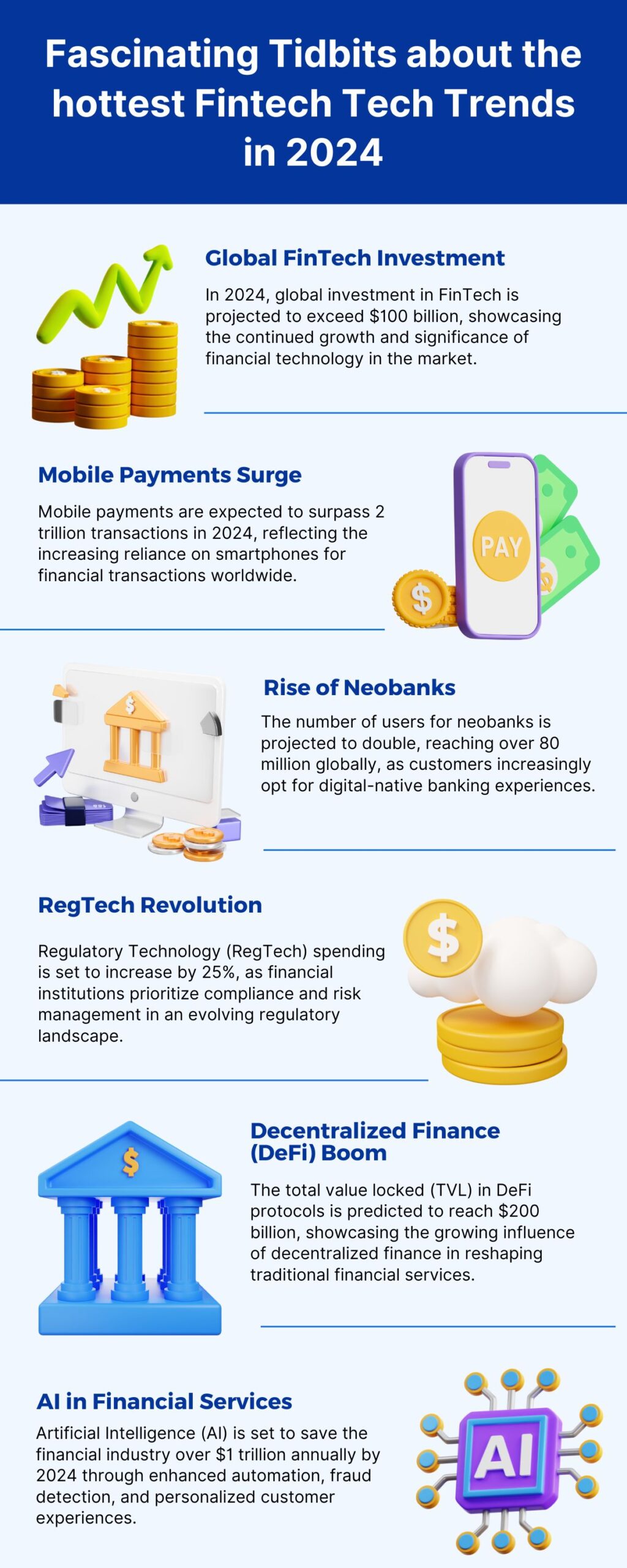

Top Banking and Fintech Trends for 2024

Top Banking and Fintech Trends for 2024

Open Banking Evolution:

Open banking continues to revolutionize the financial sector by enabling seamless sharing of financial information through APIs. In 2024, the focus will be on unparalleled payment experiences, driven by customer demands for faster, secure, and convenient transactions. Increased regulation will ensure consumer protection and fair competition.

AI and Machine Learning Impact:

Artificial intelligence and machine learning are integral to fintech, streamlining processes like expense management and reimbursement. In the coming year, AI and machine learning in banking will play a pivotal role in enhancing risk detection and fraud prevention, adding another layer of security to financial operations.

Decentralized Finance (DeFi) Surge:

DeFi, powered by blockchain technology, enables financial transactions without traditional intermediaries. With a projected exponential growth, DeFi is expected to reach new heights, disrupting global financial markets and offering P2P financial services on a decentralized scale.

Save Now, Pay Later

SNPL is an innovative twist on traditional payment methods. Empowering users to save upfront for purchases, it fosters financial discipline and aligns with responsible spending trends. SNPL positions platforms uniquely, meeting evolving consumer preferences with a distinctive feature.

“The transaction value for the Global Digital Payments Market is projected to be worth USD 11.29 trillion by 2026”

Biometric Authentication Advancements:

As cyber threats loom large, biometric authentication, including fingerprint and facial recognition, will witness substantial growth in 2024. Leading fintech companies are already incorporating these technologies for enhanced user identity verification.

Embedded Finance Revolution:

Embedded finance allows customers to access financial products seamlessly, eliminating lengthy applications. The market is predicted to reach $350 billion in 2024, paving the way for transformative developments in instant finance access.

Green Fintech Initiatives:

Green fintech tools that aid organizations in reducing their carbon footprint are gaining prominence. ESG reporting features, integrated into spending management platforms, make it easier for companies to report and act on their environmental impact.

Neobanks’ Continued Disruption:

Neobanks, with their digital-first approach, continue to disrupt traditional banking models. Their appeal to younger generations and cost-effectiveness make them a driving force for innovation in the banking industry.

Virtual Bank Cards and Mobile Payments Rise:

The adoption of virtual cards for B2B payments is on the rise, offering greater control over spending and enhanced security. Virtual bank cards and mobile payment acceptance are growing, providing flexibility to cardholders for online and in-person transactions.

RegTech’s Growing Importance:

Regulatory technology (RegTech) is becoming crucial for financial institutions to manage compliance efficiently and reduce risks. With an expected share of 50% of global compliance budgets by 2026, RegTech will continue to evolve, ensuring real-time threat detection.

How Ascertain Can Make Your Firm Unique

How Ascertain Can Make Your Firm Unique

As we explore the top fintech trends 2024, it’s essential to understand how Ascertain Technologies can uniquely position your firm in this ever-evolving landscape.

- Tailored Solutions for Tomorrow’s Challenges: We don’t just provide off-the-shelf solutions; we craft bespoke answers to the unique challenges your institution faces. Our commitment to understanding your specific needs allows us to deliver tailored tech solutions beyond your expectations.

- Innovation-Driven Approach: In a world where innovation is the currency of progress, we stand out for its unwavering commitment to staying ahead. Our constant pursuit of cutting-edge solutions ensures that your firm is not just keeping pace with trends but leading the charge.

- User-Centric Design: A technology solution is only as good as its user experience. We prioritize user-centric design, ensuring that our solutions are intuitive, seamless, and a pleasure to use. By putting user experience at the forefront, we empower your team to maximize efficiency and productivity.

- Scalability for Tomorrow’s Growth: The right technology partner doesn’t just address today’s challenges; it prepares you for the challenges of tomorrow. Our solutions are built with scalability in mind, ensuring that your firm can grow and adapt effortlessly in the face of evolving tech landscapes.

- Proactive Security Measures: As technology advances, so do the threats. We place a premium on cybersecurity, integrating proactive security measures to safeguard your institution against potential risks. Trust us to fortify your digital infrastructure, providing a secure environment for your financial operations.

Your Unique Future Awaits – Act Now with Ascertain Technologies!

Your Unique Future Awaits – Act Now with Ascertain Technologies!

In essence, banking trends 2024 promises to be a year of unparalleled innovation and technological evolution for the banking and fintech industry. As we embark on this journey, Ascertain Technologies remains committed to staying at the forefront, empowering businesses to adapt, innovate, and thrive in the dynamic tech landscape. The future is not just about embracing change; it’s about leading the change.

Ready to transform your firm? Elevate your operations, enhance customer experiences, and stay at the forefront of fintech innovation with Ascertain Technologies.